How to Streamline Your Small Business Finances Using Cloud Accounting

Running a small business comes with many challenges, and managing finances is one of the most significant. However, thanks to advancements in technology, cloud accounting has made it easier for business owners to stay on top of their financial health without the stress of manual processes. In this blog, we will explore how cloud accounting can help you streamline your financial operations, enhance efficiency, and save valuable time.

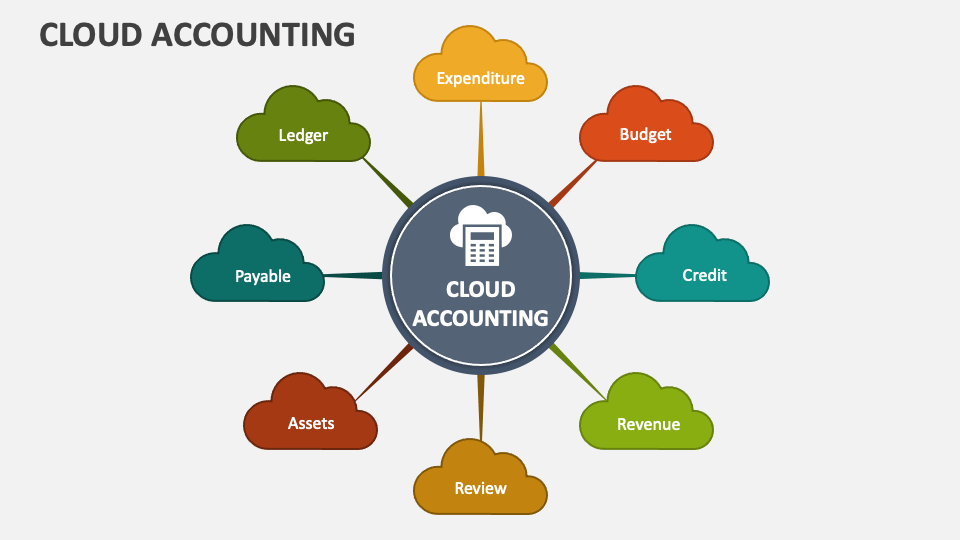

What is Cloud Accounting?

Cloud accounting refers to the use of online software to manage your business’s financial transactions, records, and reports. Unlike traditional accounting software,which requires installation on a local computer, cloud accounting solutions like QuickBooks Online, Xero, and FreshBooks store yourdata in the cloud, accessible from anywhere with an internet connection.

Benefits of Cloud Accounting for Small Businesses

1. Real-TimeAccess to Financial Data

With cloud accounting, you can view your financial statements and track your business’s performance in real-time. This eliminates the delays caused by manual updates and helps you make informed decisions on the go.

2. Automation of Repetitive Tasks

Many cloud-based platforms allow you to automate tasks like invoice generation, bill payments, and bank reconciliations. This not only reduces manual errors but also frees up time for more strategic business activities.

3. Collaboration Made Easy

Need to share financial information with your accountant or team? Cloud accounting lets multiple users access the system simultaneously, making collaboration seamless and efficient. Whether you’re working with an internal bookkeeper or an external CPA, everyone can stay on the same page with real-time data.

4. Security and Backup

Security is a major concern for business owners, especially when it comes to sensitive financial data. Cloud accounting providers use encryption technologies to protect your data, and regular backups ensure that your information is safe in case of hardware failure or cyber attacks.

How to Get Started with Cloud Accounting

Transitioning to cloud accounting is easier than you might think. The first step is selecting the right software that aligns with your business needs. QuickBooks Online and Xero are two of the most popular options for small businesses.Consider factors such as ease of use, available features, and pricing when making your decision.

Once you’ve chosen your platform, follow these steps to get started:

1. Set Up Your Chart of Accounts: Create or import your existing chart of accounts to categorize your income, expenses, and other transactions.

2. Connect Your Bank Accounts: Most cloud accounting platforms allow you to link your bank and credit card accounts directly, so transactions are automatically imported for review.

3. Configure Automation: Set up recurring invoices, automatic reminders, and bank rules to streamline routine tasks.

4. Track Performance Regularly: Use built-in reporting features to monitor key financial metrics such as cashflow, profit margins, and expenses. Regular review of the semetrics can help you identify areas for improvement and optimize your operations.

Conclusion

Adopting cloud accounting is a smart move for any small business looking to save time, reduce errors, and gain better control over their finances. With benefits like real-time data access, automation, and enhanced security, it’s no wonder that more and more businesses are making the switch. Take the first step toward simplifying your business finances by exploring cloud accounting options today.